What Happens When the AI Bubble Blows Up on Main Street?

The Hartmann Report

11/26/2025

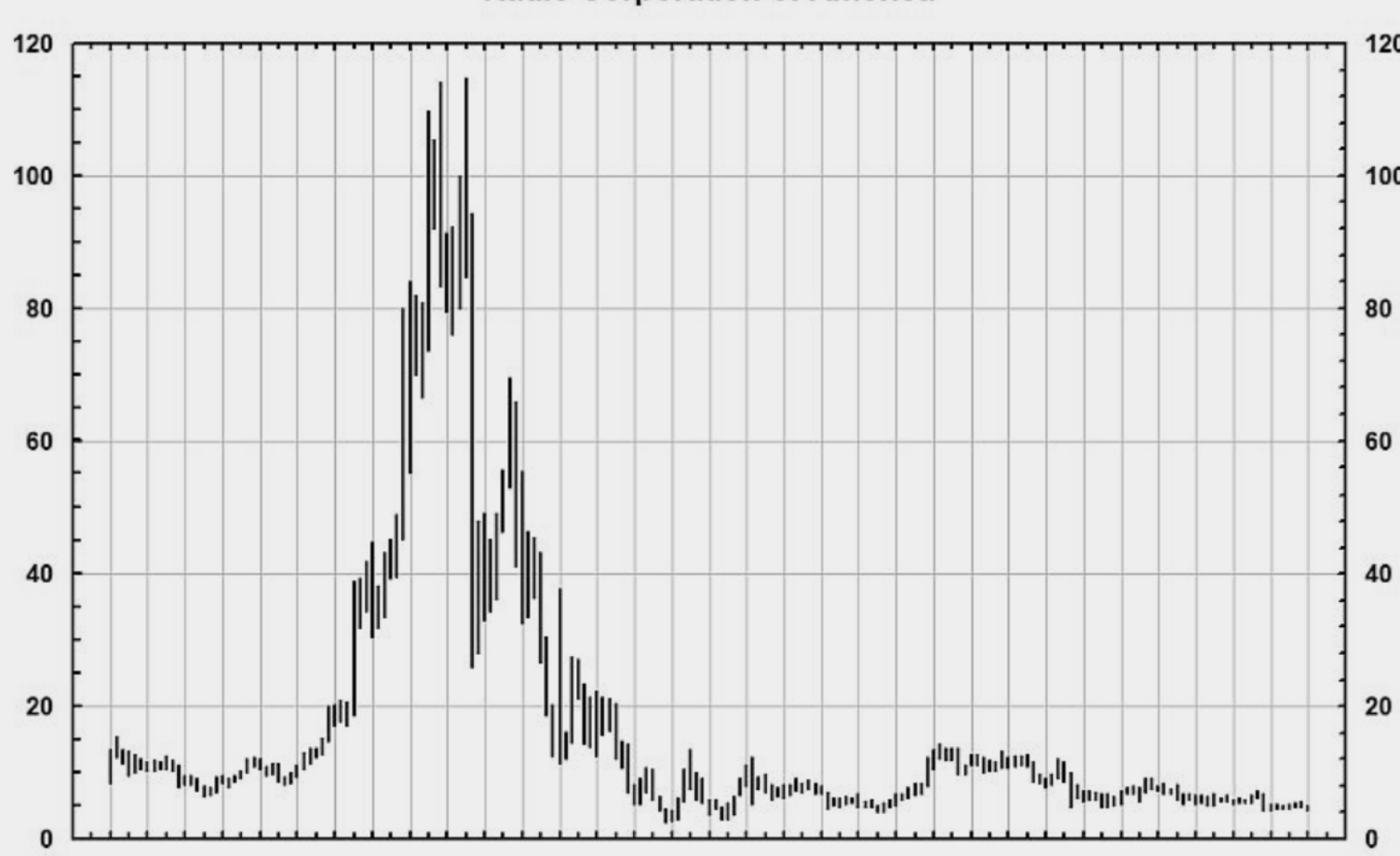

For months now, the tech world has been drunk on the language of inevitability. AI will transform everything. AI demand for electricity will double America’s power consumption. AI data centers will be the new steel mills, the new auto plants, the new engines of prosperity.

Wall Street has inflated this into a bubble so big that it’s hard to see where the hype ends and the real economy begins.

But if history teaches us anything, it’s that bubbles don’t pop harmlessly; they burst outward. And when they do, the people who had nothing to do with inflating them are usually the ones who end up paying the biggest part of the price.

We’ve seen this movie before. When the dot-com bubble collapsed in 2000, it wasn’t just stock traders who felt the pain. Entire cities that had boomed on tech spending suddenly cratered. Construction, retail, restaurants, and transit systems all took the hit.

It wiped out retirement savings, yes, but it also wiped out jobs for working people who never owned a share of Pets.com. Economists later found that the recession following the dot-com crash fell hardest on lower-income workers who had been pulled into booming metro economies that vanished overnight.

Worst of all, an AI crash could hit at a moment when tens of millions of Americans have no margin left. Inflation has been punishing, and Trump’s incoherent tariff policies have made him and his kids rich (as they use tariffs to extort foreign governments to give them billions in cash, build Trump resorts, and even gift Trump a jet plane), but they’re relentlessly jacking inflation on the rest of us.

— Housing costs have become predatory as Republican-aligned Wall Street vultures swoop in and buy up entire city blocks of single-family homes to convert into rentals.

— Medical debt from for-profit hospitals and insurance companies is pushing families into bankruptcy because Republicans refuse to even allow a discussion of single-payer healthcare like the rest of the developed world has.

—Student loans, which Republicans sued to prevent Biden from forgiving, are again grinding down young workers.

— Meanwhile, billionaires are gambling with the $4 trillion tax cut Donald Trump gave them, and that loose money is jacking the stock market like in 1929 after the Republican Harding/Coolidge/Hoover tax cuts (from 91% on the morbidly rich down to 25%).

In an economy already stretched to the breaking point, the shockwaves from a tech market collapse could intensify already obscene levels of inequality in ways we haven’t seen since the Republican Great Depression.

The wealthy will weather it. They always do. They’ll diversify, hedge, shift assets, pick up distressed real estate at a discount, and wait for the next upswing. Most will even profit from it, buying up homes, businesses, stocks, and other assets for pennies on the dollar.

America’s billionaires saw their greatest gains during the dot-com bust and the housing crash. “Cash is king” was the saying in the 1930s, as well as after the dot-com and housing crashes. And they’re muttering the same today with breathless anticipation.

But low-income and working-class Americans — the people least responsible for the bubble — will face higher electric bills, job losses, crumbling schools, gutted pensions, and reduced public services. They’ll pay for the gambles made by the same financiers and speculators who made out like bandits in 2000 and 2008.